CRYPTO MARKET ANALYSIS

When Will Crypto Bull Run Start: 7 Empowering Predictions & Key Signals in 2025

The market is coiling. Here are the seven most critical signals that could ignite the next explosive crypto rally, and what investors should be watching for right now.

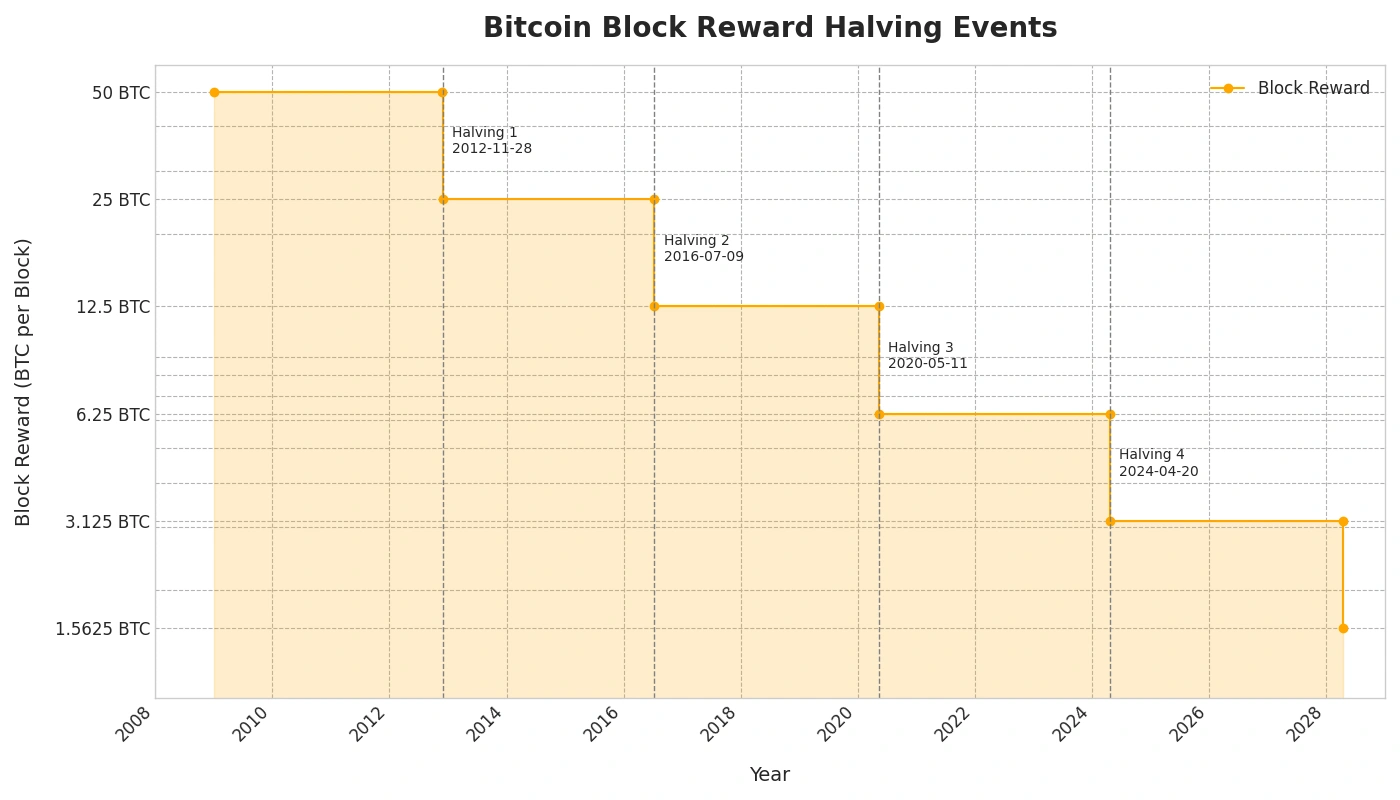

1. 2024 Bitcoin Halving – A Historical Trigger Repeating in 2025

The Bitcoin halving is a pre-programmed event that cuts the reward for mining new blocks in half, effectively slashing the new supply of Bitcoin entering the market. This supply shock is the most reliable and historically potent catalyst for a new bull market.

How halving historically fuels rallies

History provides a clear pattern: after the halvings in 2012, 2016, and 2020, Bitcoin's price entered a parabolic uptrend roughly 6-12 months later. The reduced supply, met with steady or increasing demand, creates a powerful upward pressure on price. It's a classic case of supply and demand economics playing out on a global scale.

April 2024 halving: Did it set 2025 in motion?

The April 2024 halving has already occurred, and its effects are quietly building beneath the surface. While the immediate price action was muted, the supply squeeze is now in full effect. If historical cycles repeat, we can expect the full force of this catalyst to manifest in 2025, serving as the primary engine for the next bull run.

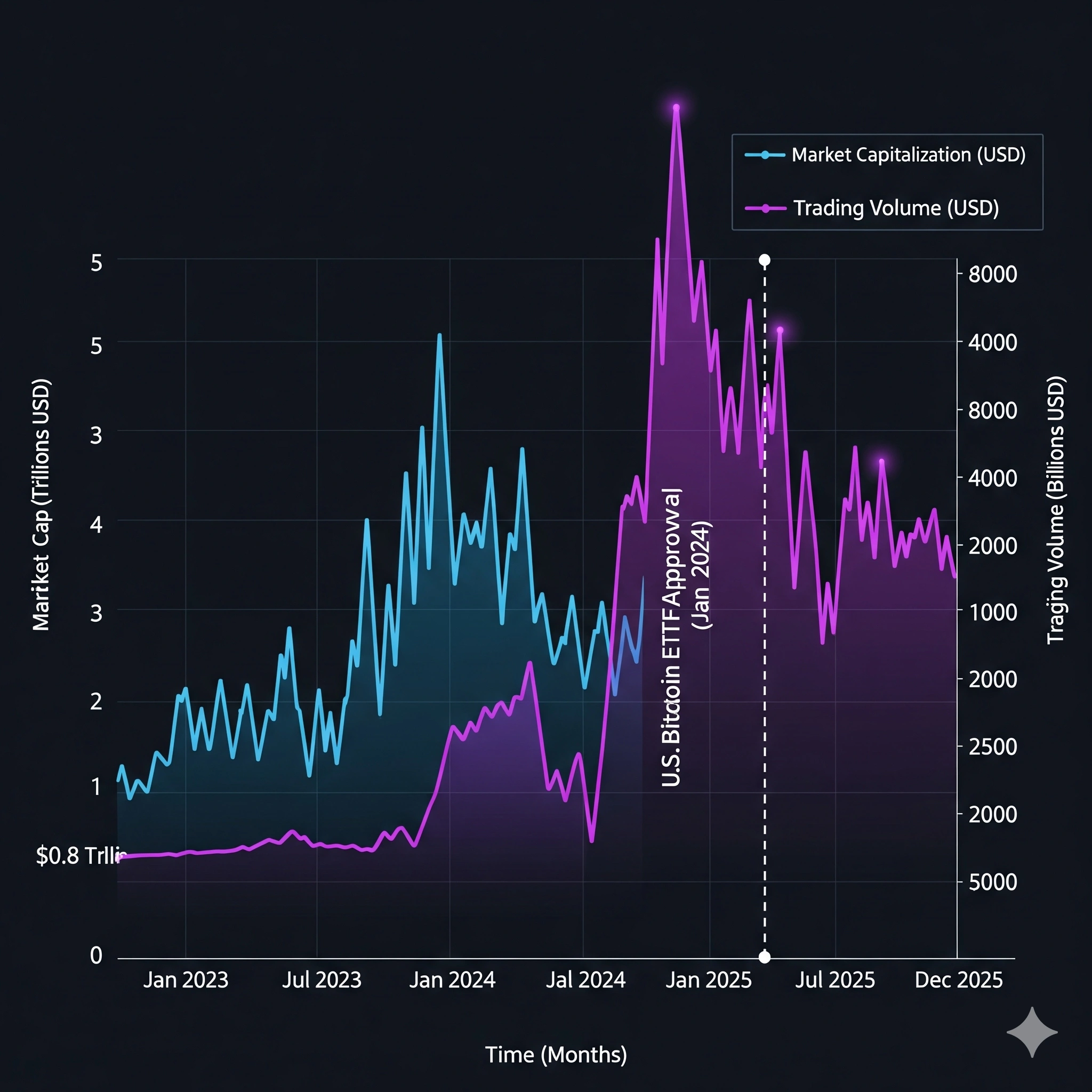

2. Spot Bitcoin ETFs & Institutional Demand Unleashed

The approval of Spot Bitcoin ETFs in 2024 was a watershed moment, opening the floodgates for institutional capital. For the first time, major financial players and everyday investors can gain Bitcoin exposure through a regulated, familiar investment vehicle.

Massive ETF inflows and scarcity

The demand from these ETFs has been staggering, often buying up more Bitcoin than is being mined each day. This creates an unprecedented demand shock that compounds the supply shock from the halving. As more wealth managers and pension funds allocate even a small percentage of their portfolios to Bitcoin, this trend is set to accelerate.

Role of strategic reserves and U.S. crypto policy

Beyond ETFs, we're seeing corporations add Bitcoin to their balance sheets as a strategic reserve. A more favorable and clear regulatory stance from the U.S. would further de-risk the asset for larger institutions, potentially unlocking trillions in new capital.

3. Macro Liquidity Tailwinds & Monetary Environment

Cryptocurrency, as a risk asset, thrives in an environment of high liquidity. The actions of central banks, particularly the U.S. Federal Reserve, act as a major tailwind or headwind for the market.

“Liquidity supercycle” and central banks’ easing

Analysts are watching for a pivot from central banks towards monetary easing (i.e., cutting interest rates). When borrowing becomes cheaper, more money flows into speculative assets like crypto. If inflation continues to cool, central banks will have the green light to cut rates in 2025, potentially kicking off a "liquidity supercycle."

Inflation expectations and investor appetite

Persistent inflation, even at lower levels, encourages investors to seek assets that can act as a store of value. Bitcoin's fixed supply makes it an attractive hedge against currency debasement, boosting its narrative and drawing in capital from investors looking to protect their purchasing power.

4. On-Chain Signals & Accumulation Behavior

The Bitcoin blockchain provides a transparent ledger of market activity. By analyzing this on-chain data, we can see clear signs of accumulation by long-term holders, which typically precedes a bull market.

Wallet flows, exchange withdrawals, miner hash rate

Key signals to watch include a sustained increase in Bitcoin being moved off exchanges into private wallets (a sign of holding, not selling), a rising hash rate (indicating miner confidence in future profitability), and an increase in the number of "accumulation addresses."

On-chain data early-warning checklist

- Exchange Supply Shock: The amount of BTC on exchanges is at multi-year lows.

- Long-Term Holder Supply: The percentage of coins held by long-term investors is near all-time highs.

- MVRV Z-Score: A metric showing when Bitcoin is over/undervalued, currently indicating room for growth.

5. Historical Timing Patterns & Cycle Extensions

While past performance is not indicative of future results, crypto markets have historically moved in predictable four-year cycles centered around the halving.

Typical 12–18 month bull duration

Historically, the bull market lasts for 12-18 months after the halving event. Based on the April 2024 halving, this timeline points to a market peak sometime between mid-2025 and late-2025.

Analyst projections for run-length into 2026-27

However, some analysts believe that with increasing market maturity and institutional involvement, cycles may be lengthening. This could mean the bull run extends well into 2026 or even 2027, with less volatility but a more sustained uptrend.

6. Altcoin Season & Meme Coin Euphoria as Telltale Signs

The flow of capital during a bull run follows a typical pattern. Watching this flow can tell us what stage of the cycle we are in.

Cycle stages: BTC → large alts → hype tokens → meme coins

First, Bitcoin leads the charge. As it reaches new highs, profits rotate into large-cap altcoins like Ethereum. From there, capital flows further down the risk curve into smaller, more speculative projects and, finally, into meme coins. This final stage is often called "altcoin season."

What meme coin mania signals in real time

When you see meme coins with no utility making headlines and experiencing parabolic gains, it's a strong signal that market euphoria is peaking. This is often a late-stage indicator, suggesting the bull run is in its final, most speculative phase and a correction may be near.

7. Real-World Catalysts: Regulation, Innovation & Narrative Shifts

Beyond the technical and macro factors, real-world events and technological breakthroughs can act as powerful accelerants.

Strategic Bitcoin reserve & government stockpile moves

News of another major corporation or even a nation-state adding Bitcoin to its reserves would be a massive vote of confidence. Any moves by governments to clarify regulations or even embrace crypto could ignite significant market momentum.

DeFi, AI, Layer-2 growth, and evolving narratives

Innovation is relentless. The growth of Layer-2 scaling solutions, the integration of AI with blockchain, and the continued expansion of Decentralized Finance (DeFi) create new narratives and use cases that attract fresh waves of users and investment, fueling the overall market.

FAQ: When Will Crypto Bull Run Start?

What exactly is a crypto bull run?

A crypto bull run, or bull market, is a sustained period where the prices of most cryptocurrencies are rising. It's characterized by high investor confidence, positive market sentiment, and significant media attention.

How long does a typical bull run last?

Based on past cycles, a bull run typically lasts between 12 and 18 months after the Bitcoin halving. However, with the market maturing, future cycles could be longer.

Is it too late to invest before the next bull run?

While the easiest gains may be in the past, analysis of the signals above suggests the market is still in an accumulation phase. Many experts believe the most explosive part of the bull run has not yet started, presenting a potential opportunity for new investors.

Which is a better investment: Bitcoin or altcoins?

Bitcoin is generally considered the safer, blue-chip crypto asset and typically leads the market. Altcoins offer higher potential returns but come with significantly higher risk. A common strategy is to hold a core position in Bitcoin and allocate a smaller portion to promising altcoins.

What is the single most important signal to watch?

While all seven signals are important, the combination of the Bitcoin halving's supply shock and the ETF-driven demand shock is arguably the most powerful and fundamental driver for the next bull run.

How high could Bitcoin go in the next bull run?

Price predictions vary widely. Some conservative estimates place the next cycle peak between $100,000 and $150,000, while more bullish analysts are targeting $250,000 or higher, driven by the unprecedented ETF inflows.

Conclusion: Is the Next Bull Run Already Started?

The evidence is compelling. The supply is shrinking, institutional demand is surging, and historical cycles are rhyming. While no one can predict the future with certainty, the convergence of these seven powerful signals suggests the crypto market is on the precipice of its next major bull run. The quiet accumulation phase may be ending, and the question is no longer *if* the bull run will start, but how soon—and whether you're positioned for it.